How College Football became a $20 Billion industry

- Prakhar

- Mar 22, 2022

- 3 min read

The NCAA is a member-led organization dedicated to the well-being and lifelong success of college athletes. Further, it is a non-profit association, which regulates athletes of 1,281 institutions, conferences, organizations, and individuals.

NCAA also organizes the athletic programs of many colleges and universities in the United States and Canada and helps over 460,000 student-athletes who compete annually in college sports. The NCAA is considered to be the dominant organization governing college sports today in the United States, and while there are other organizations like the National Association of Intercollegiate Athletics (NAIA), the NCAA has been the most prominent.

One of the key distinctions between collegiate athletics and professional athletics is the role of profit, and college sports are focused on more than just profit. Collegiate athletics focuses on interests such as student morale, campus public relations, institutional profile, fundraising, and student physical fitness. A misconception many often have about the NCAA when thinking about collegiate sports is the governing structure of the organization. Essentially, it is not a large organization that dictates what occurs in the governance of collegiate sports, but rather the NCAA is governed by its over 1,200 member institutions.

NCAA's Revenue Breakdown

The NCAA’s chief source of income from March Madness, which determines college basketball’s national champion, is the sale of the television and marketing rights to the tournament.

In 2010, the NCAA signed a 14-year, $10.8bn TV rights deal with CBS Sports and Turner Broadcasting System. In 2016, that agreement was then extended through to 2032, the networks committing to paying a further $8.8bn for the eight years added to the contract.

The NCAA’s other major revenue stream from March Madness is ticket sales.

In 2019, NCAA schools across all three divisions brought in $18.91 billion in athletic income — with about 85%, or $15.8 billion, coming from Division I schools alone.

The breakdown of incoming money looks like this:

Here are a few things points gathered from the above (Source):

36% of incoming money, or $6.78 billion, is delivered to NCAA schools via institution and government support — that number unsurprisingly drops to 28% when you look at Division I alone, as they (typically) needless financial assistance.

Regardless of division, NCAA schools generate less revenue from ticket sales, royalties, and licensing than they do from donor contributions & endowments.

Media rights, which are the biggest source of revenue for almost every major professional sports league in the world, ranked as the second-largest source of income at $2.8 billion — dwarfed by the $6.78 billion in institutional and government support.

Perhaps the most interesting way to look at it is like this — in 2019, almost 50% of the NCAA’s $18.9 billion in income came from non-sports directly related sources like institution/government support and donor contributions & endowments.

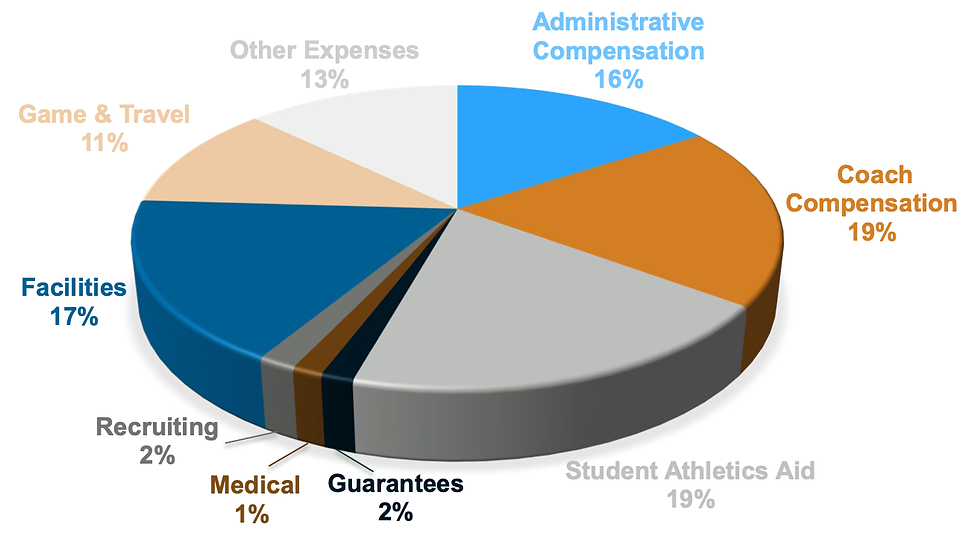

Here’s a breakdown of where the NCAA’s $18.8 billion in income was spent last year (Source):

Future of College Football

However, in the wake of numerous lawsuits over the NCAA’s amateurism requirement, the body announced in June 2021 that it was to relax its rules to allow athletes to benefit financially from their name, image, and likeness (NIL), through revenue sources such as endorsements.

In less than a year, marketing deals for NCAA players have become a more than $500 million business. But not all college athletes garnered lucrative deals, Around 81% of NIL contracts signed since July are valued at less than $100.

The NCAA hopes to introduce federal regulation of NIL to bridge the gap between existing state laws and athletes, believing that a marketplace without a national statute could be harmful by not providing fair competition. Companies such as Nike, Beats, Red Bull quickly partnered with college athletes. According to sports marketing experts, the top athletes could earn an estimated $6.5 million annually when the NIL market matures in upcoming years.

Comments